My jaw dropped when I read the latest edition of Healthcare Philanthropy, the publication of the Association of Healthcare Philanthropy(AHP). Under the heading of “The Climate of Integration” AHP says its recent gift-reporting standards recommend that charitable institutions show total productivity of fundraising efforts by recognizing revocable bequest commitments and life-income gifts at the current face value of the gift.AHP, along with its sister associations including the Partnership for Philanthropic Planning, the Association of Fundraising Professionals and the Council for Advancement “recognize a need for universal gift counting and fundraising productivity standards”. They also argue that this shift is more “donor-centric”, one that offers donor recognition based on the face-value dollar amount they are committing to.

At the risk of being seen as the mouse that roared, I find this new gift-reporting standard to be quite self-serving to AHP and its member organizations, and likely the sister associations as well. Over the past 10 years the cost to raise a dollar for AHP members has gone from roughly $0.25 to $0.33+ according to AHP’s benchmark studies. While there are many controllable and uncontrollable factors for this cost increase, the way to address this issue is not by changing the way you keep “score”. And you certainly do not change the way you keep score and claim it is for the benefit of donors.

Let’s take the example of a 60 year-old donor of a $100,000 charitable gift annuity. While the net present value (or charitable value) of this CGA may be around $60,000 the new AHP et. al. standard calls for counting it as $100,000. I can understand crediting the $100,000 toward a campaign goal, or even toward a legacy recognition opportunity valued at $100,000. That is inside baseball. But to call it a reflection of fundraising productivity is not factual or legitimate, nor should it be used as a basis for benchmarking an industry. A better reflection of fundraising productivity would be to have secured a $100,000 outright gift from the donor and counting the $100,000 gift or pledge.

I can assure you the CFO of this organization does not see the CGA as a $100,000 asset on the balance sheet, nor would he/she with any other deferred, revocable gift. In fact, the CGA shows up as a long-term liability. I have found the shortest route to earning the distain of a CFO and CEO is for an advancement office to “count” money and report money that is not there.

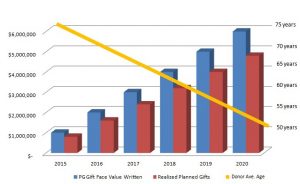

If AHP et. al. want to find a universal unit(s) to measure fundraising productivity across organizational sectors, do not feel compelled to measure everything in dollars or through one bottom line figure. For consistent benchmark reporting, I suggest counting gift revenue like the CFO would count it. AND, you can also count the number of: will expectancy notifications; face value of deferred gifts written, planned gifts realized and average age of these planned giving donors.

You cannot measure this kind of productivity through a gross revenue figure.

Your takes:

1. Major gifts can sometimes be a negotiation.

2. Generally Accepted Accounting Principles (GAAP) are generally not negotiable.

3. You decisions about gift crediting should be ensconced in policy and pass the smell test.